The U.S. Department of Education has partnered with the Internal Revenue Service to allow you and your parents to transfer your 2015 tax return information directly from IRS records to your online application. Using this option when you complete your FAFSA should allow you to file an application with fewer mistakes.

File 2015 Income Tax Returns

Collect these items and documents

Get an FSA ID for you & one of your parents (if dependent)

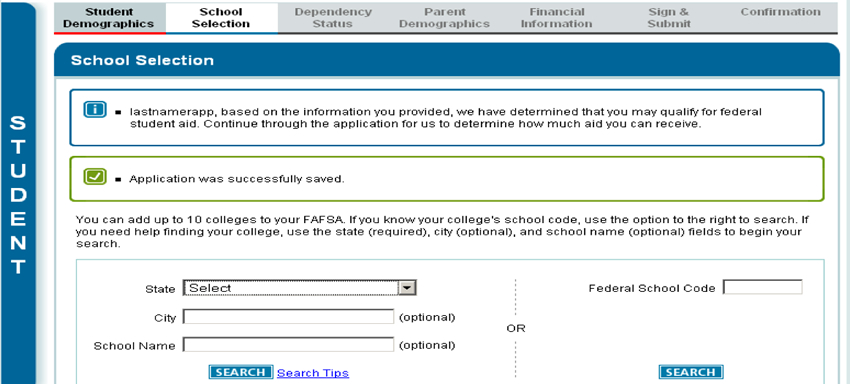

File your FAFSA on the Web (FOTW) at: http://www.fafsa.gov

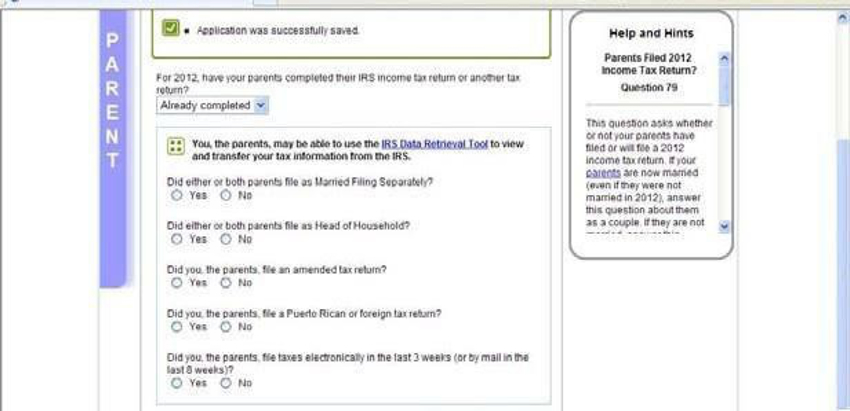

The IRS Data Retrieval Tool allows you and your parents to transfer tax information from IRS tax records directly to your FAFSA. If you & your parents have indicated on your FAFSA that you have already filed your 2015 taxes, you will be given the option to use this tool when completing the financial information portion of the application. If you choose not to use this option, or use the option but manually update one of the fields, you may be selected for verification and have to submit additional information to the Financial Aid Office after your application is processed.

Please Note:

To use this option you must:

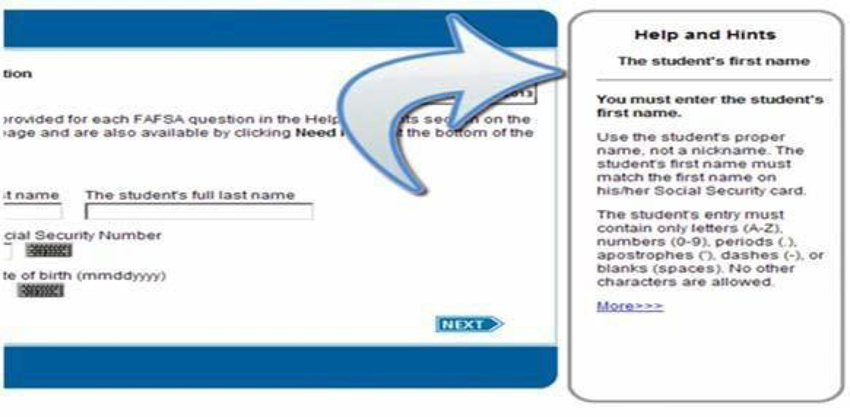

FOTW determines if you are eligible to use the IRS Data Retrieval Tool based on your reported tax filing status.

Some tax filers may not be able to use the IRS Data Retrieval Tool and will have to enter their data from their own tax records. You or your parents will not be offered this option if:

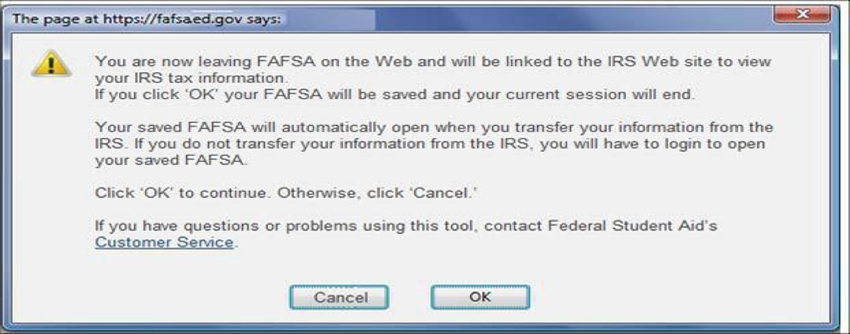

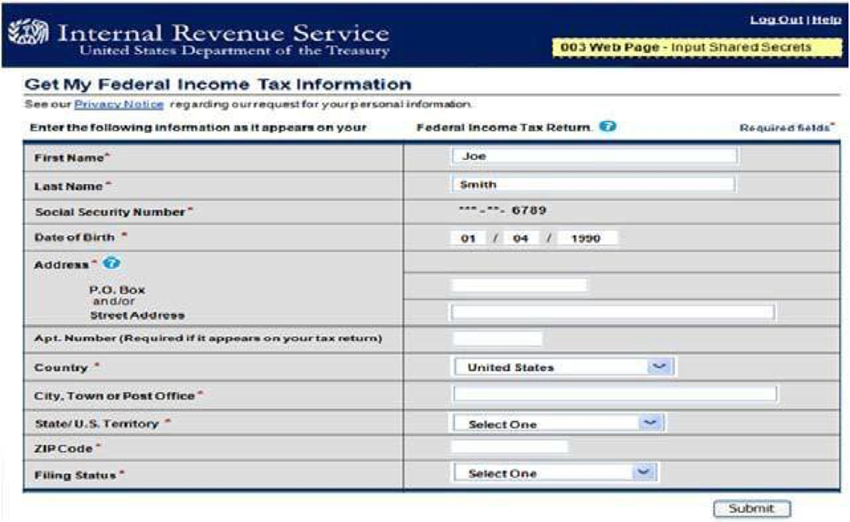

If eligible to use the tool, you will be transferred to the IRS Website. FOTW will notify you that you are leaving the FAFSA website and entering the IRS website to complete the transfer of your tax information.

on your tax return. It is important that you complete this section exactly as it appears on your tax return or your information may not match with IRS records and the data retrieval may not go through.

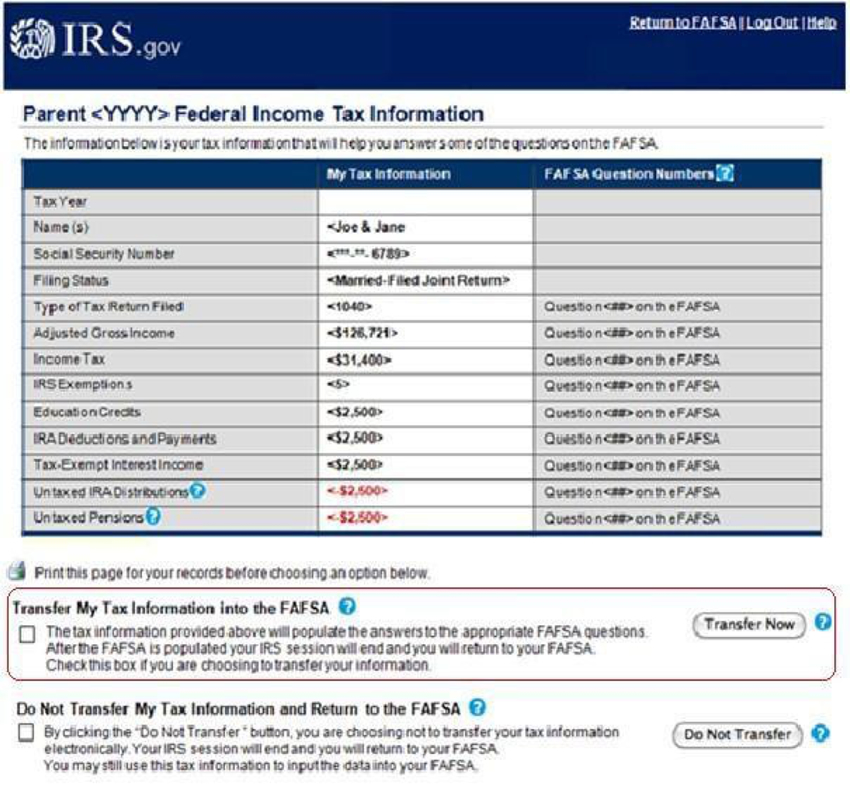

Once the IRS has authenticated your identity, your IRS tax information will display. You may then choose to transfer your information from the IRS into your FAFSA by checking the "Transfer My Tax Information into the FAFSA" and clicking "Transfer Now" button (see below).

After you have transferred your data, you will be returned to the FOTW website to finish your application. Make sure not to change any of the financial data that was imported from the IRS Website. Remember that both you and your parents (if applicable) will need to go through a separate authentication process when filling out the Student Financial Information & the Parent Financial Information sections of the FAFSA.

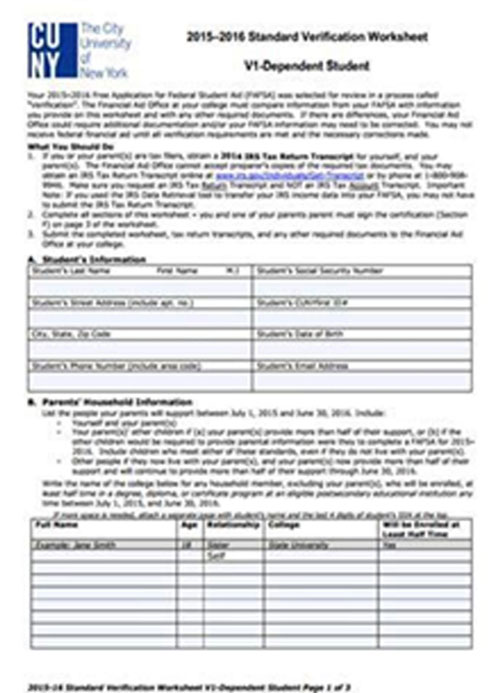

The federal government uses a process called verification to help determine the correctness of the financial information on your FAFSA. When applications are selected for verification, the Financial Aid Office must collect certain documents from you and your family and match them against the information you provided on your FAFSA. If your application needs to be verified, the Financial Aid Office will send you a letter asking you to provide documentation of your application information and complete a "Verification Worksheet". You will have to submit the requested items of documentation before you receive any payments of federal financial aid.

Tax Filers

If you or your parents did not or could not use the IRS Data Retrieval option when you completed your FAFSA, or manually changed any information transferred from IRS records to your FAFSA, you will have to submit a IRS Tax Return Transcript as one of the required documents in order to complete verification. We can no longer accept copies of tax returns that you or your tax preparer completed. Learn how to obtain a free tax transcript on p. 9.

Non-Tax Filers

If you have earnings from work but did not and were not required to file a 2015 federal income tax return, document this income by attaching all W-2 forms and/or 1099 forms from all sources of employment to the Verification Worksheet.

Other Verification Items

Depending on your individual circumstances, you may be asked to confirm or document the correctness of additional FAFSA data items before your application can be finalized. If you are required to submit additional information for verification, you will receive notification from the Financial Aid Office.

If you, your spouse (if married) or your parents (if dependent) need to document your taxable income to fulfill verification requirements, you can request an IRS Tax Return Transcript free of charge. Remember that we can no longer accept copies of the tax returns that you or your tax preparer completed. You may only submit documents that come directly from the IRS to complete verification of your tax return information. There are two ways to request a tax transcript from the IRS.

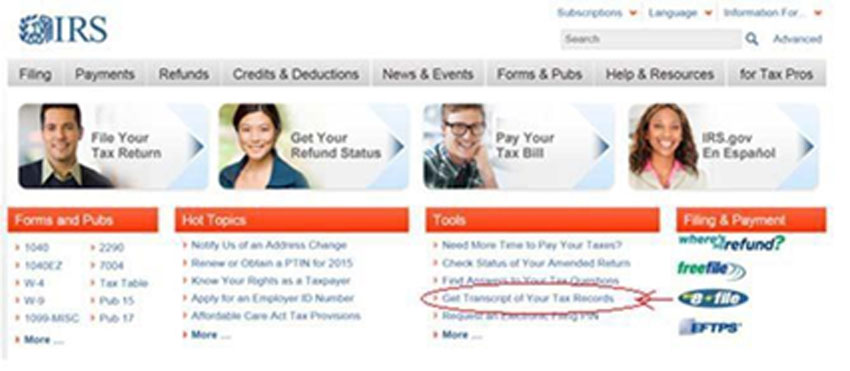

Online Request

Go to the IRS Web site at www.irs.gov. Click “Get Transcript of Your Tax Records” on the homepage and follow the steps to order your tax return transcript. The tax filer will have two options to order the transcript. One option will be to get the transcript online immediately. In order to get the transcript online, the tax filer will have to follow the steps to verify their identity. The second option is to get the transcript by mail. The transcript will arrive 5-10 calendar days after the request was submitted to the address the tax filer provided in the online request.

Telephone Request

Call the IRS at 1-800-908-9946. Follow the prompts to enter required information and select IRS Tax Return Transcript option. If successfully validated, tax filers can expect to receive a paper IRS Tax Return Transcript at the address that was used in their telephone request within 5 to 10 days from the time the IRS receives the request.

Tuition Assistance Program (TAP)

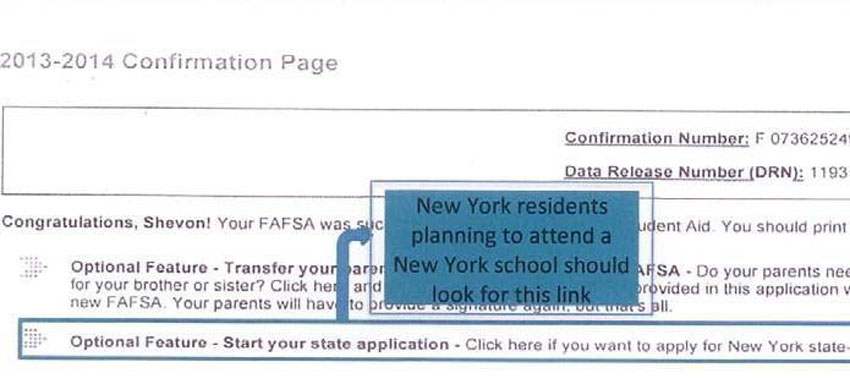

When you have finished filing FOTW, click on “Optional Feature — Start your state application” located on the FAFSA Confirmation page to link to New York State’s TAP-On-the-Web (TOTW) application. Note: if you are not a New York State resident, this option will not be available to you. TAP gives eligible students full-time and part-time tuition awards to supplement any federal student aid you may be receiving.

APTS (Aid for Part-Time Study)

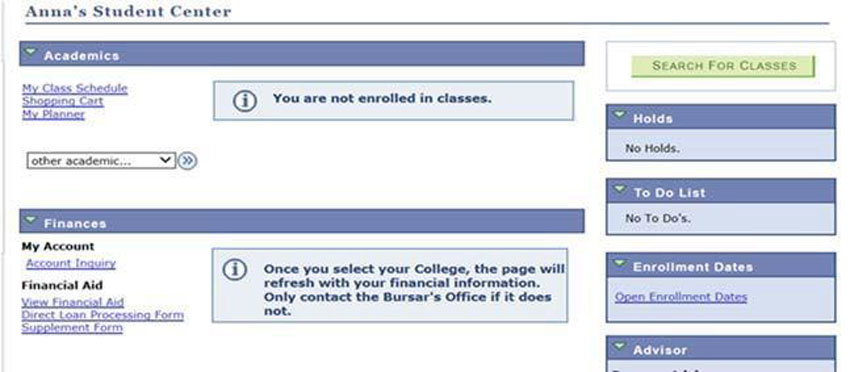

If you plan to attend City Tech as a part-time student, you may be eligible for a New York State Aid for Part-Time Study (APTS) award. After completing your New York State TAP application, you will need to complete a CUNY Supplement Form to be considered for this award. Log on to CUNYfirst to access the Supplement Form. The Supplement Form can be found by going to “Self Service” located on the left menu in CUNYfirst. After you are in Self Service, click on the “Student Center” link. Under the Finances Section, you will find the Supplement Form. Select NYT01 for the institution and 2017 for the aid year.

CUNY’s Scholar Support Prepaid Card is a faster and easier way for you to get and manage your financial aid and work-study payments. Your financial aid grant, loan and work-study payments are automatically deposited to a prepaid MasterCard on the scheduled disbursement date. There is no more waiting for a check to arrive in the mail. This card is accepted at any store or ATM where MasterCard debit cards are accepted. Learn more about this option and enroll to receive your card at: http://www.cuny.edu/admissions/financial-aid/info-resources/scholars-support.html